Some or every one of the expert services explained herein is probably not permissible for KPMG audit shoppers as well as their affiliate marketers or similar entities.

Segment 321.3 - Loans to executive officers and administrators(a) A financial institution may not generate a loan to an government officer or director unless the loan (1) is built on conditions, such as interest price and collateral, that aren't additional favorable to The chief officer or director than These customarily made available from the lender to folks that are not government officers or administrators and who're not employed via the bank, and (two) will not entail in excess of the traditional risk of repayment or current other unfavorable characteristics.(b) Exception. Absolutely nothing in subdivision (a) of this portion shall prohibit any extension of credit score manufactured pursuant to some benefit or payment application: (one) that is certainly widely accessible to workforce with the bank; and(two) does not give choice to any government officer of director of your bank in excess of other personnel on the bank.

You don’t ought to consent to be a affliction of shopping for any house, goods or products and services. Information/facts prices might apply. By coming into your details and clicking “submit," that you are calling American Pacific Mortgage loan and concur that we may possibly email you about your inquiry. Additionally you comply with our Phrases of Use and Privateness Plan. You may Unsubscribe Anytime by replying to any e-mail from us and change the topic line to “Unsubscribe” or e-mail us at compliance@apmortgage.com to Choose out. Post

Energetic-duty military services, their spouse or dependents coated by the Military services Lending Act (MLA) might not pledge any vehicle as collateral. If you are included by the MLA, You're not suitable for secured loans.Loan proceeds cannot be employed for postsecondary educational bills as defined by the CFPB's Regulation Z such as college or university, university or vocational expense; for almost any organization or commercial reason; to get copyright belongings, securities, derivatives or other speculative investments; or for gambling or illegal uses.

Small-phrase particular loans are typically safer and fewer pricey than payday loans and should still be offered Should you have undesirable credit rating.

At the moment—as long as your property fairness is at least twenty%—you'll be able to take into account refinancing to some reduced long term charge.

Not surprisingly, loan phrases also depend upon the lenders. Most lenders have a bare minimum time period number of three yrs but it really can be done to locate lenders which offer even shorter phrases.

Offered the anticipations the fees may possibly go down afterwards this yr or early future year, you could possibly think about a one-0 buydown home loan Therefore reducing your upfront Price.

As with all other form of credit, your credit rating rating is often destroyed for those who fail to create on-time payments in comprehensive monthly, or When you have Regular late payments. This isn't exceptional to small-phrase particular loans.

In conclusion, a 3-2-1 buydown home loan features the two small-time period and extended-expression Positive aspects. The instant Expense personal savings during the early decades can give you more money adaptability, while the gradual increase in interest rates permits a smoother changeover to bigger regular monthly payments.

Comprehending Buydowns Buydowns are straightforward to comprehend if you think that of these like a house loan subsidy supplied by the vendor on behalf from get more info the homebuyer. Normally, the vendor contributes money to an escrow account that subsidizes the loan in the course of the initially several years, resulting in a lessen regular payment within the home loan.

Occasionally, the vendor or 3rd party may well give you a partial buydown payment. This may be expressed being a share of the overall loan or even a flat charge. In the example earlier mentioned, the vendor may possibly give to pay two% from the loan amount or a flat $2,000.

The Fresh Begin program, which gave Gains to borrowers who were delinquent previous to the pandemic payment pause, also shut on Sept. thirty. For the duration of this limited method, pupil loan borrowers who ended up in default prior to the pandemic got the chance to get rid of their loans from default, permitting them to enroll in profits-driven payment strategies, or submit an application for deferment, among the other Advantages.

"[Borrowers] will acquire credit for months in default … from March 2020 for the date they ended up no more in default a result of the Fresh new Start initiative," Kantrowitz mentioned. "Additionally they get credit rating for qualifying payments designed previous to going into default."

Haley Joel Osment Then & Now!

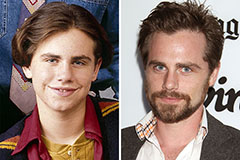

Haley Joel Osment Then & Now! Rider Strong Then & Now!

Rider Strong Then & Now! Romeo Miller Then & Now!

Romeo Miller Then & Now! Amanda Bearse Then & Now!

Amanda Bearse Then & Now! Naomi Grossman Then & Now!

Naomi Grossman Then & Now!